In the throes of an escalating climate crisis, one can’t help but acknowledge the pivotal role of economics in exacerbating and potentially alleviating the situation. As global temperatures have risen, with 19 of the hottest 20 years on record occurring since 2001, a pressing question has emerged: “Can economic tools be wielded to reverse this trajectory?“

Enter Carbon Markets—a seemingly arcane concept at the intersection of environmental policy and market-based solutions. As carbon dioxide levels touched a staggering 414 parts per million in 2020, the highest in over 800,000 years, the urgency to understand and harness the potential of carbon markets has never been more palpable. By the end of this piece, you’ll grasp not only the mechanics of carbon markets but also their global significance, challenges, and potential future.

As the sun beats down on our ever-warming globe and climate change headlines dominate our daily digest, nations grapple with formidable solutions. Among the roster of eco-initiatives, carbon markets shine with promise. Delve into this intricate world, which marries environmental imperatives with economic incentives.

A Primer on Carbon Market

At its core, carbon markets function on a simple and profound premise: put a price on carbon, and you can curb its emissions. Underneath this foundational idea lies a multi-layered system:

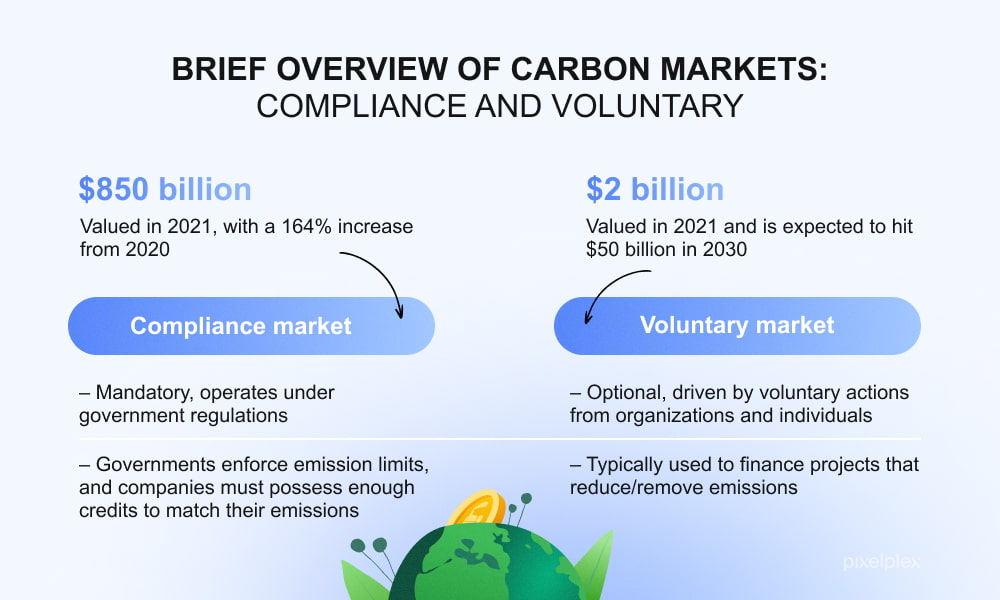

- Regulatory bodies place a quantitative cap on emissions, establishing a ‘ceiling’ for greenhouse gas emissions over a period.

- Companies are allocated or can purchase, emission permits. Those who cut emissions below their permitted level can sell their extra permits. Meanwhile, those exceeding limits must buy permits or face penalties.

Let us walk back in time and discuss the genesis of the Carbon Markets. The 1997 Kyoto Protocol sowed the seeds of today’s carbon markets, introducing global mechanisms like the Clean Development Mechanism (CDM) and Joint Implementation (JI) to encourage international collaboration. However, leveraging markets to address environmental issues was floated in the 1960s.

Carbon Markets Around the World

EU ETS: Europe took a pioneering step with the European Union Emissions Trading System in 2005. Spanning 31 countries, the system has impressively reduced the EU’s emissions by over 1.3 billion tonnes between 2005 and 2019.

California’s Quest: Since its 2013 inception, California’s Cap-and-Trade Program has achieved a 13% reduction in greenhouse gas emissions, even as its economy flourished by 26%.

China’s Leap: Beginning as a pilot in 2011 and formally launched in 2017, China’s National Carbon Market is particularly noteworthy given China’s status as the world’s top emitter.

So, why is there such a profound significance around 1.5 degrees Celsius? Why are we collectively rallying around these numbers? Consider this: a 0.5°C difference could dictate the survival of our invaluable coral reefs. With a 1.5°C rise, we stand to lose 70-90% of our reefs, but a 2°C hike would obliterate over 99% of them.

Economically, the stakes are monumental. By 2021, climate change was draining a staggering $790 billion annually due to its harmful effects.

The carbon landscape is a dynamic domain, with the weight of global aspirations and environmental imperatives resting on its shoulders. However, as with any pioneering effort, this landscape is not devoid of its challenges. To unravel the intricacies of this evolving market, we must delve deep, spotlighting the hurdles that stand in the way of a sustainable carbon economy.

- Regulatory Inconsistencies

Each nation or region has its own set of rules regarding carbon trading, making it complex for global businesses to navigate. The European Union’s Emissions Trading System (EU ETS) and California’s Cap-and-Trade Program have diverse regulations. Established in 2005, the EU ETS covers around 45% of the EU’s greenhouse gas emissions, while California’s program aims to reduce emissions by 40% by 2030. Differences in scopes and targets can pose challenges for international corporations. - Carbon Price Volatility

Carbon prices fluctuate based on supply and demand, policy changes, and geopolitical events. A primary example of the above was in 2017, when carbon prices in the EU ETS plummeted to as low as €5 per tonne, primarily due to an oversupply of allowances. However, by 2019, prices rebounded to €25-30, reflecting market adjustments and policy tweaks. - Double Counting and Offsetting

There’s the risk of “double counting” emissions reductions, i.e., two parties claiming credit for the same reduction. This can be understood from the Clean Development Mechanism (CDM) example under the Kyoto Protocol, where concerns arose about specific projects getting credits without leading to real-world emission reductions, leading to inflation of carbon savings. - Environmental Integrity Concerns

Not all carbon credits are created equal; some projects offer more tangible benefits than others. To understand the same, a Stanford study revealed that 37% of offset projects under the CDM would have proceeded even without the added incentive of carbon credits, terming them “non-additional.” - Economic Implications on Developing Nations

Carbon pricing can have disparate impacts on economies at varying development stages. Take an example from India, home to a significant portion of the world’s poor, grapples with the need for rapid industrialization to alleviate poverty and the environmental implications of carbon-intensive growth. Balancing carbon market participation with developmental needs remains a challenge. - Technological Constraints

Effective carbon trading requires advanced monitoring, reporting, and verification (MRV) systems. For example, Forest carbon projects in the Amazon require satellite imagery and ground-level monitoring to ensure accurate carbon sequestration accounting. The integration of these technologies at scale can be resource-intensive. - Public Perception and Trust

The credibility of carbon markets is occasionally questioned due to past failures or perceived inadequacies. For example, Australia’s carbon pricing mechanism, introduced in 2012, was repealed in 2014 amidst political controversies and public scepticism. - Future Integration with Parallel Mechanisms Multiple climate mitigation mechanisms exist, and their integration with carbon markets can pose challenges. South Korea’s integration with the ETS with its Renewable Portfolio Standard has been a point of debate, as both aim to reduce emissions but through different means.

In a rapidly modernizing world, sustainability is more than just a buzzword—it’s an imperative. Current global trends indicate that by 2050, the world’s urban population is expected to nearly double, making sustainable practices crucial. The World Bank data suggests that cities produce over 80% of global GDP but contribute about 70% of global carbon emissions.

Against this backdrop, a fascinating paradigm emerges the fusion of time-tested strategies with avant-garde innovations. Developed over centuries, historical practices offer a treasure trove of environmental insights. For instance, traditional agricultural methods often promoted crop rotation and organic fertilization, minimizing soil degradation. In comparison, contemporary innovations bring forward tools like satellite imagery and AI to monitor and optimize land usage.

However, the challenge isn’t just about incorporating old techniques but creating a synergy with the new. A 2018 Global Commission on the Economy and Climate report found that bold climate action could deliver at least $26 trillion in economic benefits by 2030. Thus, weaving the threads of the past with the fabric of the future can lead to ecological and substantial economic advantages.

The potential blueprint for a sustainable, prosperous global future lies in this delicate balancing act between past wisdom and present innovation.

Therefore, as the global community grapples with a crisis of unprecedented scale, the stakes are higher than ever. With a potential economic loss pegged at $23 trillion per annum by the end of the century due to unchecked climate change, carbon markets aren’t just an option—they are an imperative. Our responsibility lies in constantly refining, expanding, and adapting them to meet the intricate challenges of a warming world. As we gaze into the future, carbon markets could be the key that reconciles our industrial aspirations with the undeniable need for environmental stewardship. The balance of our planet’s health and economic prosperity might rest on this pivotal intersection.

PS: Images credit to the originators and creators